If you go back to September 2019 you will find the answer.

You can’t read the news these days without finding an article on inflation. Around the globe prices and wages are on the rise. This is happening across the board from oil and metals, to consumer goods and services. Yet at the same time the Fed seems to be taking a very cautious approach to raising rates and rolling back Quantitative Easing.

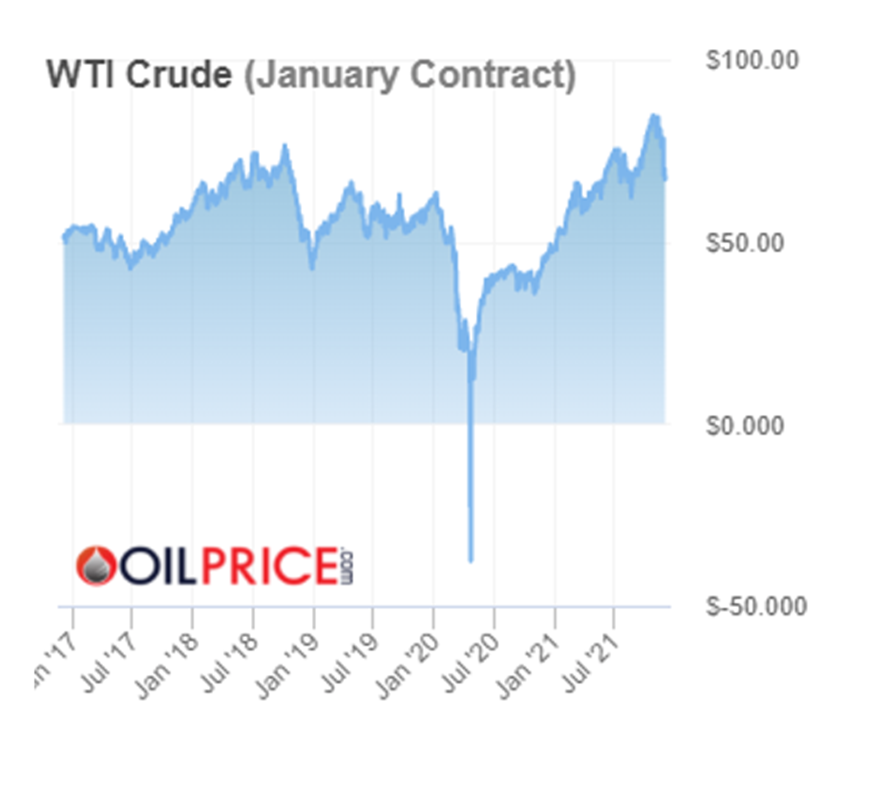

One argument, is that the current inflationary cycle is transitory — singularly created by the pandemic and subsequent the supply chain issues. But, more and more this argument is faltering and if the oil prices go to $100 per barrel (as some predict) you can be sure we are in for higher prices for some time to come. Wages also do not look like they will be coming down either. In the US they are up 5% in the past 12 months and job vacancies have reached 10+ million.

The question then arises as to why the Fed doesn’t act now. After all, they should be able to see clearly what is happening to the economy. For me, the answer lies in a pre-Covid event of Sept 2019.

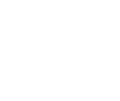

What you see above is a chart of the overnight interest rate from 2014 to 2019. In general rates kept in a relatively close range tracking the effective federal funds rate (EFFR), which is a median of rates paid by banks and which the FOMC sets a target range for, as well as the secured overnight financing rate (SOFR), the median rate on overnight collateralized loans known as “repos” that are made to a wide range of institutions. From 2015 until early September 2019, the EFFR had stayed within the FOMC’s target range on all but one day and rarely moved much. The SOFR had been somewhat more variable, especially around quarter-end and year-end financial statement reporting dates, but rarely moved more than a quarter of a percentage point outside the EFFR target range. Then, on September 17, 2019, the EFFR moved above the top of the target range and the SOFR soared nearly 3 percentage points.

This was caused by two factors. The less important one, was quarterly tax payments that were due of roughly $100 billion. The much more significant one, was that the treasury increased its long-term debt by $54 billion by paying off maturing securities and issuing a larger quantity of new ones. Buyers of the new debt paid for it by withdrawing money from banks and money market accounts.

This was part of the tapering which started in 2019, but suddenly went haywire. The only way to quell the ensuing liquidity crunch was for the Fed to pump $75 billion into the money markets through bond repos. The great experiment of rolling back QE failed.

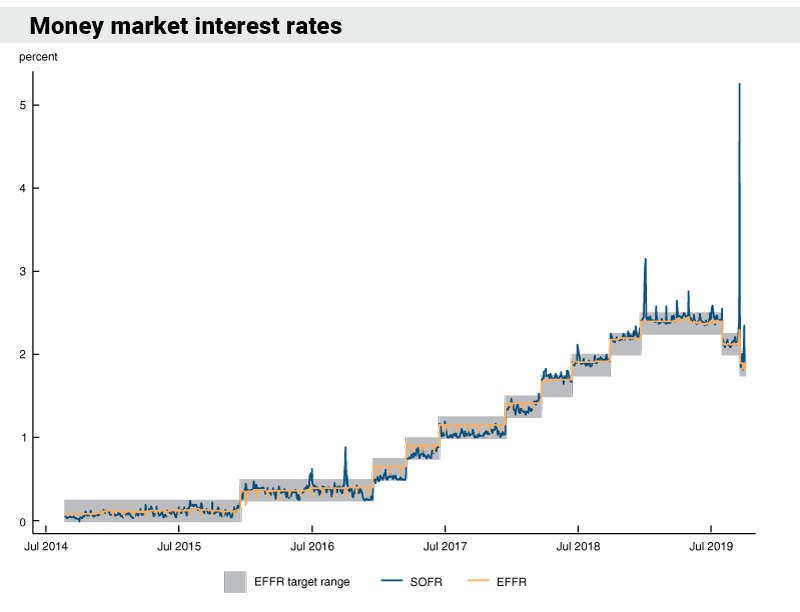

Since the 2008 Global Financial Crisis, US public debt has ballooned and along with that private debt. Around 70% of global debt is US Dollar denominated, so changes in US rates and liquidity, have a global impact.

All major economies have been issuing increasing amounts of debt in a bid to reach a circa 2% inflation target (which up to now was illusive). So an increase in rates is a very big problem for a massively indebted world. You have to remember that increasing the rate from 1% to 2% is a 100% increase in the interest you pay. In a massively leveraged environment that is a big issue. The Fed, Bank of Japan, PBOC and ECB simply cannot afford to take a risk of a spike in rates. The global economy is and will remain hooked on cheap money.

So what does that mean for inflation and specifically commodities?

Photo by engin akyurt on Unsplash

In general the debasement of the value of money (through the continual printing of it) will be inflationary. Whilst, individual commodities have their own price dynamics, metals and agricultural products are in one way or another, linked to the price of oil.

Whilst we see sensitivity of the oil price to “lock downs” the trend is clearly up. Governments having to sell strategic reserves is a clear sign of demand side pressure, at a time when the supply becomes increasingly costly through a shortage of labour, investment and equipment.

So inflation does not look so transitory, but we should not expect the central banks to come to the rescue of the poor consumer any time soon.