What you should know about elevated prices, global inventories, supply & demand and volatility.

Prices

We see elevated prices across the board — Oil, Metals, Agriculture. Most of this is being blamed on circumstances related to Covid, QE and global conflict. The fact of the matter is that prices were already moving higher pre-Covid and well before the war in Ukraine. These issues are merely aggravating an already tight supply situation. The big issues have been a lack of investment in commodities, climate change and diminishing natural resources. The clean energy transition will take decades to complete and will require huge investment – eventually this will lead to lower prices, but this is going to take time.

Inventories

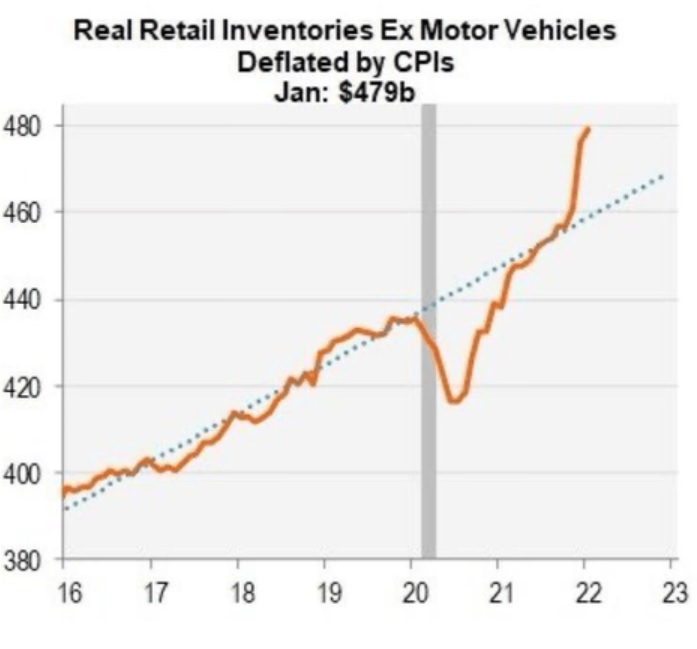

Stocks of metals and agricultural products have been in decline for 5 years already. Oil is notoriously hard to store in the volumes required. Global oil demand is at 100 million bbls per day and likely to continue to increase up to 2030. Despite the collapse of oil demand in 2020, we find ourselves at critically low stock levels, forcing governments to release strategic reserves.

Demand & Supply

Shipping delays and availability forced manufacturers to stock more than was usually needed — “Just in time” delivery has moved to “material supply security”. This is a scenario where supply chain tightness is creating circular demand.

However, recent data suggest that ship waiting times are easing and rates are coming down.

At the same time inventories of finished goods are rising. Consumers are turning down their heating and delaying purchases.

Demand for selective nonferrous metals will likely remain high (EV related) and production constrained in some cases (aluminium) but a shock to the housing market in China combined with and unknown Covid outcome, could offset a lot of bullishness. Talk of recession is hitting the newswires on a daily basis. Consumer confidence is waning and investment is slowing down.

Volatility

It’s looking like a tale of two halves.

Tight energy markets pushing up the price of everything. Extended conflict in Ukraine driving food prices to worrying levels. Metals demand strong, driven by energy transition.

Volatility on commodities exchanges has increased significantly and liquidity is drying up. Cash management is proving challenging to say the least. This is impacting even the biggest companies. See this comment by Shell relating to their Q1 results;

“Reflecting the unprecedented volatility in commodity prices prevailing up to the end of the quarter, material additional movements could be seen in CFFO [Cash Flow From Operations] from margining effects on derivatives, changes in inventory volumes and in accounts payable and receivables”

Yet on the other hand inflation is killing demand as many simply won’t have the means to afford some of the most basic necessities. Even those that saved during the pandemic are reluctant to spend due to a high level of uncertainty.

We should continue to see extreme levels of volatility as the opposing sides of tight supply and low stocks, play out against inflation and demand destruction.

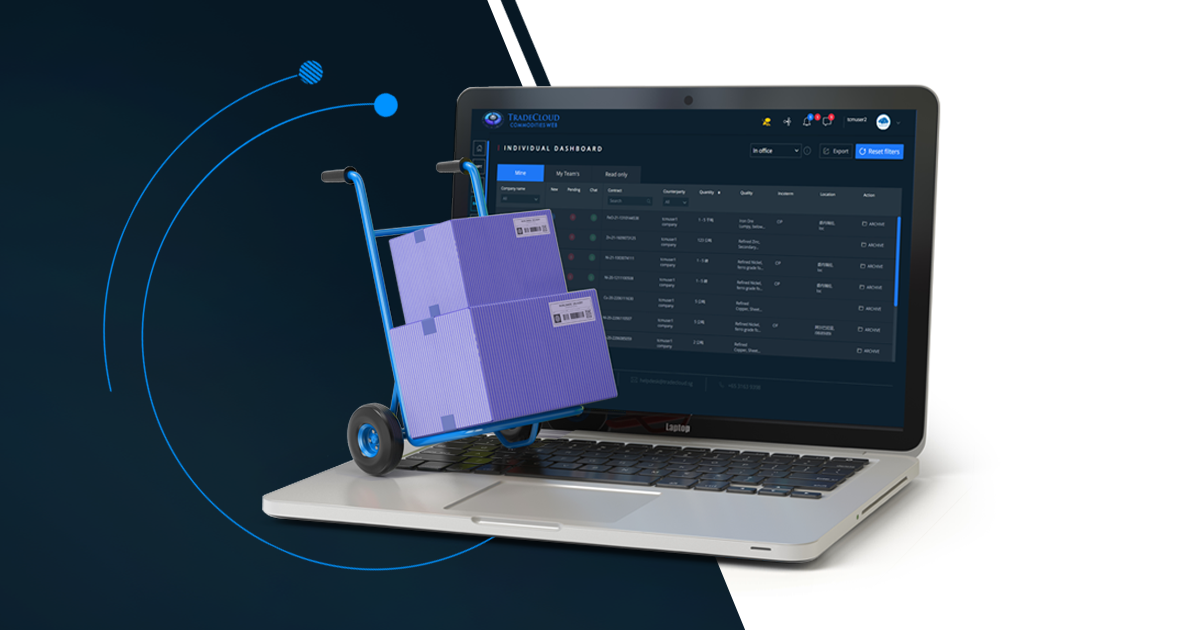

Managing your commodity business has never been harder. A high price environment and extreme volatility requires careful management and expertise. TradeCloud’s experienced team has just that. We’ve been through the good times and the bad and know what needs to be done. Having the right team, technology and experience is crucial. Talk to us.

About TradeCloud

The TradeCloud platform enables customers to manage all communications in the physical life cycle of a commodity transaction, in a secure environment, from origination through to order fulfillment. This enables customers to greatly increase efficiencies, reduce security risks, improve customer service, and benefit from vastly improved business data management previously lacking in the industry