The LME price has seen a circa 35% price increase this year but this only on a portion of the increase that consumers are actually paying.

Once the laggard of the metals complex, aluminium has been one of the best performing metals on the London Metal Exchange this year. But the full price that consumers are actually paying to get metal delivered to their factory door is even more remarkable.

Whilst people tend to look at the headline 3 months price, the premiums that consumers are having to pay have been dramatic. The US Mid West Transaction Price (the premium over the LME price that a customer has to pay to have metal delivered to their plant) has jumped from around 15 cents/lb at the beginning of the year to 34 cents/lb today. This means the real price a US customer has to pay for aluminium has gone from $2350/mt in January, 2021 to the current price of $3400/mt. On top of this premiums for aluminium semi-products such as slabs, billets and alloys have sky rocketed globally, reaching numbers never previously registered. In Europe there are reports of certain types of billets trading $1400/mt premium over the LME. Meaning consumers are paying over $4000/mt for aluminium metal to be delivered.

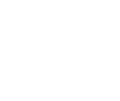

There are many factors at play here including higher ocean freight, container availability, trucking costs, energy prices and strong demand. These are all fuelling higher prices and premiums. However, the single most important factor in the market has been China. Despite the China State Reserve Bureau making an announcement to release 210,000 mts this year (see chart) from the strategic stockpile the price has remained strong.

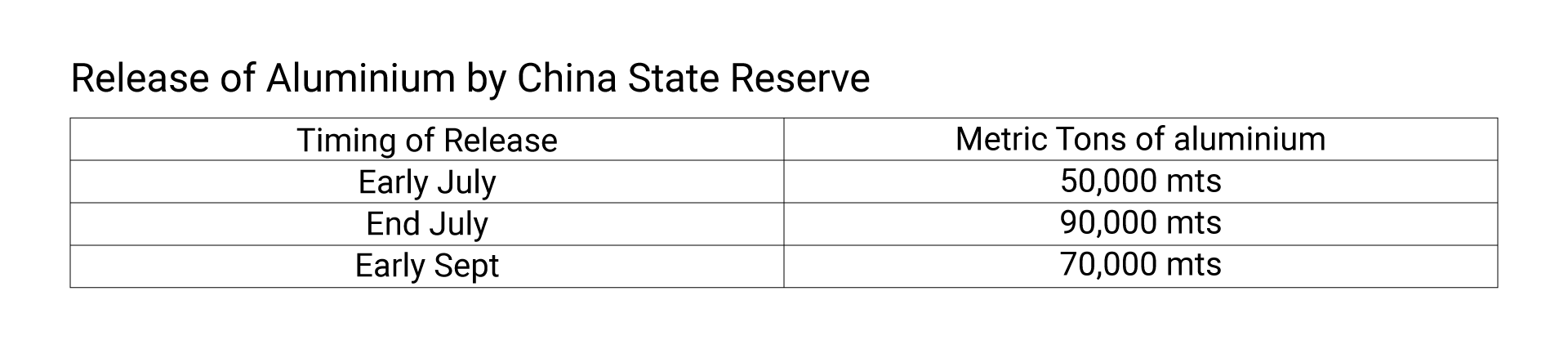

Over the past 3 decades increase in Chinese demand has been met with an increase in Chinese smelting capacity and output. But recently this has been different and we can see this reflected in the Chinese import/export data.

China’s import of primary aluminium and alloyed aluminium.

China’s alumium boom since the 1990’s has been primarily powered by coal. Whilst China has an abundance of coal, it no longer has an appetite for the CO2 this producers. As a signatory to the Paris Agreement, China is committed to avoiding climate change through the reduction of carbon emissions. As China is largest single producer of aluminium on the planet and production is predominantly coal powered, there is a clear conflict. This summer we have seen various ways in which China has reduced the power loading to its smelters reducing the overall output.

At the same time, coal prices have remained stubbornly high. With the world having an aversion to the production of coal and most major mining companies getting out of the business, the situation is not likely to change in the medium term. So we have a situation of high coal prices, leading to high power prices in China, leading to stagnant growth of aluminium production.

On the demand side, the story line looks bullish. The green revolution needs all kinds of metals and whilst cobalt, nickel and copper have been in the headlines, aluminium is a versatile light weight metals that can reduce your carbon foot print for the life time of the product you buy. Increasing usage of alumium continues to be seen in automotive, construction and power lines.

ING research unit just stated “We maintain our price forecasts for 3Q21 at US$2,600/t (quarterly average) and expect annual average prices could rise from this year’s US$2,420 to above US$2,630 in 2022 and US$2,700 in 2023”

These numbers, however, don’t include those crazy premiums that I wrote about above. Fastmarkets are reporting spot premiums for aluminium billets in the $1,200-$1,250/mt range delivered Europe, but importantly Fastmarkets are also reporting offers for Q1, 2022 in the $1,300-$1,500/mt range.

So in fact $4,000/mt aluminium looks like the new reality and could be with us for some time to come.

At TradeCloud our goal was to build a communications platform specifically designed for the commodities industry. This meant that news and information was a priority and the reason why we built a collaboration with Fastmarkets to bring you the latest metals news directly on the TradeCloud mobile app.

As highlighted above, commodity markets can be volatile and unpredictable. However, if you want to significantly reduce the risk of market volatility, it’s best to be well informed and be able to connect seamlessly with the growing network on TradeCloud.

Fastmarkets news is just one feature amongst many we have created for a more informed, secure and compliant environment for the commodities industry of the future.

If you would like to learn more about how we are going about this, please feel to contact us via info@tradecloud.sg