How ESG is rapidly changing the dynamics of the commodity trading business – creating new challenges and new opportunities.

I have often asked people in meetings what a commodity is? Firstly, they wonder why I am asking such a basic question and then after some reflection try to give an answer. Normally that will consist of replying that it is a “basic raw material or agricultural product”, something that is naturally found or grown. In fact the correct economic definition of a commodity is “a homogenous good for sale in the market”. I would argue that under this definition an iPhone12 is closer to the economic definition of a commodity than crude oil, copper or wheat. The reason being that although an iPhone12 is a highly technical product, it is exactly the same no matter where you buy it, or who you buy it from. A basic product, on the other hand, is naturally occurring, comes from the ground and will have different characteristics depending on where you source it from. Brent crude is different to WTI, which is different to Murban.

So commodities (or primary materials as we commonly know them) can vary considerably depending on where they are produced and how they are processed. Until recently it is the physical attributes on those goods which have determined their price, but things are changing fast as the consumer becomes increasingly concerned about the provenance of the goods – not just what they are, but how were they produced and brought to market. Today, when people buy food in their local supermarket, they are asking questions like;

“was this grown in a greenhouse or in the open air?”

“is it genetically modified or not?”

“was it produced using fair-pay labour?”

“it is locally sourced?”

Questions around ethical sourcing and environmental impact have come to the front when it comes to consumers determining what goods to buy. Importantly, this goes all along the supply chain; car manufactures, technology companies, construction companies are coming under tremendous pressure to follow ESG principles which are being driven by all of us. For the time being the rules of the new game are not entirely clear. They can be driven by legislation (bio-components in diesel) by incentives (carbon credits) by investors (assessment of ESG factors) and of course by social media (corporate cancel culture)

Determining the value of goods has become very complicated. Not only do you need to consider the quality, location, duty factors, payment conditions and performance risk, you also need to consider an increasing array of other factors.

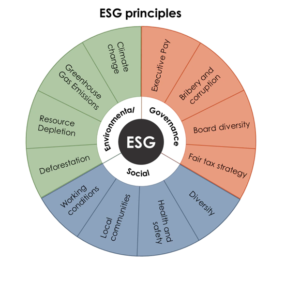

(Image Source: https://www.theprivateoffice.com/investing/what-is-esg-investing)

The above diagram is a relatively basic breakdown, but more topics to are being discussed every day. Furthermore, each component can be broken down into numerous sub-components. The vital point is what factors are more important and to what degree? Is it Environment, Social or Governance? and if it is Environment, is it Resource Depletion or Deforestation? The truth is that everyone (and every company) has their own ESG score card. This means everyones’ valuation of the goods is different from an ESG point of view.

The development of commodity supply chains has embedded considerations about the physical attributes of the commodity moving through that supply chain. The way any supply chain operates is driven by these physical attributes and as much as it is driven by economic or logistical considerations. These physical characteristics are inextricably attached to the commodity itself, however, the new ESG attributes are not. ESG attributes need to be indelibly linked to the commodity itself in order for stakeholders to realise the value of their ESG activities. This is why blockchain, cloud, IoT and other emerging technologies are needed to unlock the value of ESG efforts, but must be applied in a way that interoperates 100% with the actual physical supply chain of the commodity itself. ESG attributes must be inextricably attached to the actual commodity, as physical attributes are today.

Currently, most major commodities are priced using pricing benchmarks (published by price reporting agencies), or via exchanges, that allow the physical delivery of goods based on their physical quality. But going forwards we will have significant differentiation in the market based on ESG factors and this is going to play an increasingly important role in determining the final price.

Producers, traders and consumers, will find it tougher determining what ESG factors are important and what investment is needed today to have the right outcome for tomorrow. Consumers and traders need to work out what commodities not to buy and how to find the goods they really need with the right ESG attributes. As markets become increasingly de-commoditised through this development, finding the right goods at the right price will only become harder.

Simon Collins is the CEO and Co-Founder of TradeCloud

About TradeCloud

At TradeCloud, we know that the commodities industry needs a secure communications platform bringing trusted parties together to carry out business. We are enabling communications with cutting-edge technology that gives our customers improved Visibility, Provenance, Compliance, Collaboration and Security compared to their traditional communications channels. TradeCloud Commodities Web using cloud computing and blockchain technology connects post-trade services such as freight, finance, and risk management and is driving unparalleled digital change across the physical commodities industry. Write to us at info@tradecloud.sg or visit www.tradecloud.sg to know more.