by Simon Collins | CEO — TradeCloud

What’s the connection and why are we seeing all this volatility?

As economies cautiously move back to normality it’s strange that everyone is talking about inflation already.

2020 was marked by the enormous printing of money by central banks, leading to a debasement of all major currencies. So no one should be surprised by the rise in the value of coins such as Bitcoin, Ethereum and even Dogecoin. After all, it just a simple question of supply and demand. Bitcoin has a fixed supply (or at least you have to work hard through mining* to produce more). On the other hand USD, Euro and Yen have plentiful supply as there appears no end to Quantitative Easing. Throw in a little speculative frenzy and we see the coin market go from a market cap of circa $250 Bln to over $1.5 Tr.

(See graph below)

Total Market Cap of Major Crypto Currencies (1yr)

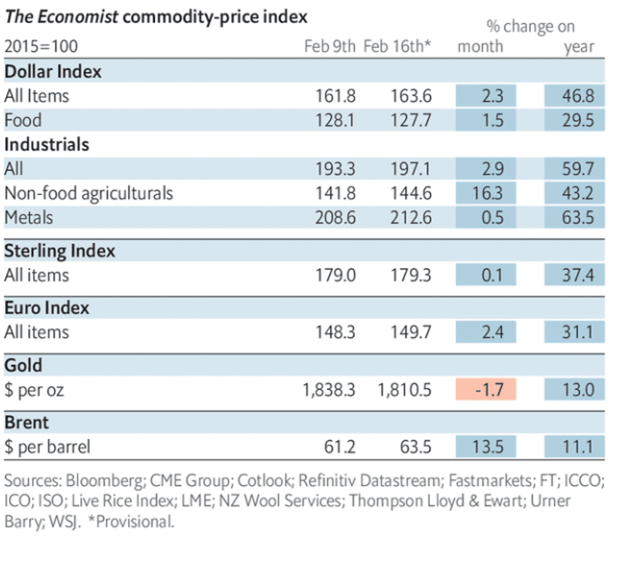

The same applies to commodities –

Producing more of them is just not that easy in the short term. One year on from the real impact of Covid and look at what has happened to prices.

From agriculture to metals to oil, we can see major price increases across the board. All well above pre-Covid levels. In some products such as oil, this may only be the beginning of the bull run.

There are a few factors are at play here.

- Demand is picking up — People are driving more and online retail therapy has surged.

- Investment in oil and metals collapsed in 2020 as producers scrambled to preserve cash.

- Investors are running away from oil and into renewables.

- Interest rates at the back end of the curve are picking up and people are putting their money into “inflation-proof” asset = commodities / property / banks.

In a low-interest-rate environment, the sensitivity of assets prices to rate increases is crazy. Going from zero percent interest rate to one percent, is an increase of infinity? But look at it another way; Infinity is any number divided by zero:

∞ = N/0

So in a zero interest rate environment, the value of an asset (N in the example above) can be infinite based on a discounted cash value model. So when you move the interest rate from zero to something more normal like 1.5%, you can have some really big changes.

As we see 10-year rates increasing, investors are starting to hit the panic button on some of the lofty valued growth stocks and instead are flocking to hard assets. Afterall, in 2008 US property prices only dropped by 20%. Nothing, when you compare to what could happen to tech stocks if we really have inflation and interest rates move above 1.5%.

SO, WHAT’S NEXT?

The bottom line is money in the form of major currencies, has questionable value. Asset values are going to be very sensitive to interest rate movements and rates could move quite dramatically in absolute numbers. In the past 12 months 10 year US treasuries have been as low as 0.4% and as high as 1.39% — that’s over 200% increase.

If 2020 was “bust to boom” year, then 2021 will be the year of volatility.

ABOUT TRADECLOUD

At TradeCloud, we know that the commodities industry needs a secure communications platform bringing trusted parties together to carry out business. We are enabling communications with cutting-edge technology that gives our customers improved Visibility, Efficiency, Compliance, Collaboration and Security compared to their traditional communications channels.

Built by people who truly understand the physical commodities business TradeCloud is a secure network of trusted parties enabled to find and execute the optimal Trade. Established in 2016, TradeCloud has more than 500 member companies across more than 60 countries. TradeCloud Commodities Web using cloud computing, and blockchain technology connect post-trade services such as freight, finance, and risk management and is driving unparalleled digital change across the physical commodities industry. Write to us at info@tradecloud.sg or visit www.tradecloud.sg to know more.

ABOUT TRADECLOUD SECURITY TOKENS

We launched the TradeCloud Security Tokens in 2019 as a means to fund the future development of the platform. The TradeCloud Token (TC Token) is a means for investors to purchase future services on the platform and to share in its success. TC Token will have the unique feature of being an exchange of value for services provided by the platform, as well as being an opportunity to benefit from the future profitability of TradeCloud.

*The term (crypto mining) means gaining cryptocurrencies by solving cryptographic equations through the use of computers. This process involves validating data blocks and adding transaction records to a public record (ledger) known as a blockchain.